As a New Zealand resident, you might wonder what the best online international money transfer platform for quick and easy fund transactions. Especially if you are living in NZ as a migrant, you might want to send funds to your loved ones in India, Philippines, Sri Lanka, Bangladesh, Pakistan, Nepal etc.

Don’t worry! We have put together the top three financial platforms to transfer funds abroad from New Zealand. We considered their key features, pros and cons, as highlighted by several verified users, varying exchange rates, transfer charges, speed of fund remittance, coverage, customer support, and ease of use.

Best Online Platforms to Send Money to International Bank Account in New Zealand

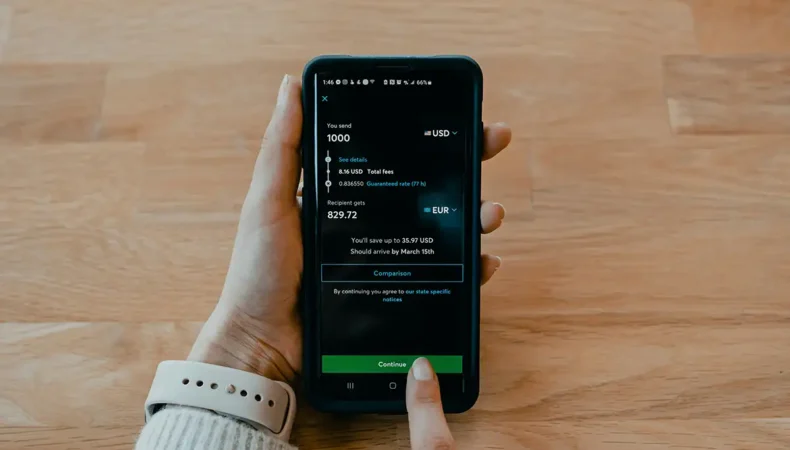

#1:- Wise Transfer

Wise, previously known as TransferWise, is one of the finest Fintech companies for transferring money globally. It’s headquartered in London and was founded in January 2011. Currently, it has about 16 million users.

With Wise, you can transfer money to about 160 countries from New Zealand, and it supports over 40 currencies. The transfer reaches the receiver in less than 48 business working hours.

It is a legitimate platform with a 4.3/5 overall rating and about 90% 5-star ratings from 38,000+ verified reviews on Trustpilot. Many users find the platform user-friendly.

Wise Security and Data Protection

Wise is regulated in over 65 countries worldwide. In addition to having PCI DSS, SOC 2 Type 2, SOC 1 Type 2, and ISO 27001 certifications, Wise is GDPR compliant. It uses two-factor authentication (2FA), has a dedicated fraud combating team, and is regularly audited by independent finance and IT auditors. Thus, they protect your data and secure your account using stringent measures.

Exchange Rates, Charges, and Transfer Limits

The minimum transferable amount is NZD 1, while the maximum by bank transfer is 2.2 million NZD. You can also send a maximum of 5000 NZD by POLi and 10,000 NZD by card per transaction.

One of Wise’s selling points is that it operates a mid-market exchange rate, which is not achievable by many competitors. The transfer fee is also competitive but might not be very competitive for funds over NZD 10,000. Thus, this option is suitable for small and medium-sized transfers.

Here is a table showing the charges on funds transfer at the moment.

| Payment Methods | Transfer Fee |

| Bank Transfer | 1.77NZD + 0.27% |

| POLi | 1.77NZD + 0.27% + (Poli Fee = 2.64 NZD) |

| Credit Card | 1.77NZD + 0.27% + (Credit Card Fee = 14.58 NZD) |

| Debit Card | 1.77NZD + 0.27% + (Credit Card Fee = 14.58 NZD) |

Pros

- No exchange rate markups or hidden fees

- Easy account setup

- Regulated in several regions globally

- Compatible with Google Pay, Apple Pay, Debit or credit card for transfer abroad

Cons

- Average customer support

- Account closure or restriction without prior notice

Steps to Sending Money From New Zealand Abroad Using Wise

- Register for free using your email address or a Facebook or Google account.

- Input the amount you want to send; the calculator will show the fee on the calculator.

- Fill in the bank details of the receiver

- Verify your identity with a photo of your Identification card

- Send the funds through any of the payment methods

#2:- Orbit Remit

At number two is Orbit Remit, a multi-award-winning international money remittance company founded in 2008. The New Zealand-based company, headquartered in Wellington, New Zealand, has over 500,000 users. Tommy Heptinstall and Robbie Sampson founded the company to give migrant communities and people living abroad a seamless and transparent experience when performing international transfers.

Orbit Remit has a whopping 4.9/5 rating on Trustpilot and 31365 reviews, 85% of which are 5-star ratings. In fact, users believe they have an excellent money transfer service. You can transfer to 26 countries from New Zealand. The primary way to transfer is through Bank transfer. Receivers can get the payment through bank accounts, local cash pickup, and wallet accounts based on country.

Orbit Remit Security and Data Protection

Orbit is registered as a financial service provider with registration number FSP7721. The Department of Internal Affairs (DIA) oversees the platform as a money remitter and is further listed as a reporting platform with Company Number 2174112 & NZBN 9429032555066. They also comply with local licensing rules and regulations and monitor customers’ accounts for fraud.

The mobile app and website portal also integrate security features. These include two-factor authentication, Secure Socket Layer (SSL) Encryption, SHA 256 SSL, and Biometric verification as extra security layers to ascertain the user’s identity.

Lastly, OrbitRemit encrypts all data using secure coding languages while maintaining a valid and trustworthy web certificate for tighter security.

Exchange Rates, Charges, and Transfer Limits

Money sent gets to the recipient mostly that day or in less than 72 hours. The limit per transfer depends on the country you are transferring to. For instance, there is no maximum amount when transferring to a recipient’s personal account in the US. However, if it is a US business account, the maximum per transfer is 80,000 USD.

Also, there is a fixed fee for transfers below 10,000 of any currency unit. The fees are waived for units higher than 10,000. For instance, there is a 4 NZD fixed fee for less than 10,000 NZD. The exchange rate, however, also includes a markup of the mid-market rate. The transfer fee is instead added to the total amount you want to transfer.

For instance, the exchange rate of 1 NZD = 0.59429 USD, 1000 NZD = 594.29 USD, you will pay a 4 NZD transfer fee, thus 1004 NZD in total for your receiver to get the 594.29 USD.

Pros

- They are trustworthy and offer high-speed money transfer services

- Excellent customer support

- Suitable for higher value transfer

Cons

- Limited coverage

- Hidden charges

How to send money Abroad from New Zealand Using Orbit Remit?

- Create an account

- Verify your detail

- Input the receiver’s details,

- Finally, pay for the transfer, and the money will be sent

#3:- Western Union

Western Union takes the third spot on our list and is arguably one of the biggest international money transfer providers. The money transfer giants have existed long, specifically since 1851.

The biggest advantage of using Western Union is its coverage. You can send money to any country worldwide except Iran and North Korea. You can transfer money online or offline by walking into about 500,000 physical locations worldwide. Thus, the receiver either collects the funds in local currency in the bank or at any of their designated agent’s physical locations.

Western Union is trustworthy. It has a rating of about 66%, 5 stars, 101912 reviews, and a 4.2/5 overall rating.

Western Union Security and Data Protection

Western Union is a trusted platform that complies with each country’s applicable government laws and regulations where you send money within its coverage. Money transfers through Western Union are encrypted.

The platform also uses technologies like SSL to protect your personal information. It also has a strong customer authentication (SCA) payment process known as 3D secure. This multi-factor system acts as an extra layer to protect digital payments. This SCA payment authentication includes using PIN, password, or biometric data.

Exchange Rates, Charges, and Transfer Limits

Online, you can only transfer up to 5,000 NZD within three days. But to make higher-value transfers, you must go to an agent location. The speed of arrival depends on the country to which you send the money and the mode of collection. Nevertheless, cash collections are primarily available for the receiver in minutes, but bank deposits take less than five days.

However, the exchange rate and charges on Western Union can be complicated because of the hidden charges. For instance, at the time of writing (27th October 2024), the mid-market rate for NZD to USD is 1 NZD = 0.5978 USD. Thus, 1000 NZD = 597.8 USD. However, the FX rate on Western Union is 1.00 NZD = 0.5971 USD (delivery within two days) when received in a bank account and 1.00 NZD = 0.5705 USD (within minutes), and no fee is charged for both. However, that implies that 1000 NZD = 597.1 USD and 570.5 USD for both methods. Thus exposing the hidden charges.

Pros

- Various payment methods are available via Apple Pay, Credit or Debit Card, Online via POLi with your bank account, and at any agent location.

- Comprehensive coverage and availability of physical locations

Cons

- There are hidden charges or exchange rate markups

- It can be stressful going to an agent’s location for higher-value transfers.

Steps to sending money abroad From New Zealand Using Western Union

- Create an account on the Western Union website or app and verify your identity with your driving license or New Zealand passport.

- You can get a quote about the fees and rates by choosing the country of the receiver, the amount, and the currency you want to send money.

- Input the relevant details of the receiver.

- Choose a payment method (bank transfer, debit, or credit card) and send funds.

Note: If you want to send cash, you can walk into any of their designated agent locations. You can check the nearest agent to you here.

Conclusion

These top three international money transfer remitters not only provide cheap transfer services but also ensure fund safety and transparency and that recipients get the funds quickly across borders. Thus, you can try any one of them that suits your needs. Among the above three services, Wise Transfer is my favourite one. This is because I always get a slight increase in the conversion rate while sending money to India compared to the other two services.

Last modified: November 2, 2024